ABOUT US

Our promoters have more than two decades

of experience in the capital markets.

Beeline Capital Advisors

WHO WE ARE ?

We, at Beeline Capital Advisors Pvt. Ltd., are providing services in various areas of capital markets which include Merchant Banking Services, Corporate Advisory Services, and Asset Management Services. Our promoters are having more than 2 decades of experience in the capital markets. We are actively working in SME Listing, Valuation of companies for various transactions, fund raising, migration to main board, mergers and acquisition, takeovers.

Currently, we are advising to more than 55 listed companies for their capital market needs. We also have NBFC for catering various financial needs of our clients.

Services we offer

Initial Public Offerings

(IPO- Main Board & SME)

Valuation

Open Offer & Take Over

Migration from SME to

Main Board

Delisting & Buyback

Right Issue

OPEN OFFERS & TAKE OVER

A takeover Offer is a type of action in which an offer

is being made to acquire another listed company.

It could be made by

an individual or a group or any legal Entity,

which is known as the acquirer, while the subject matter of the bid is referred to as the target company. The takeover offer could be a Friendly offer or could be a Hostile Offer.

Securities and Exchange Board of India (substantial acquisition of shares and Takeovers) Regulations, 2011 is the primary piece of law which regulates Takeovers of Listed Companies in India.

An Open Offer is made to the Public shareholders of target company pursuant to a Trigger event as prescribed in regulations to provide them an exit opportunity in case the public shareholders are not willing to continue with the company and/or upcoming management pursuant to Takeover Offer.

A Merchant Banker called as Manager to the Offer is a Registered Intermediary who make sure that SEBI (SAST) Regulations are well complied in the Offer and in addition act to prevent any loss to any Public shareholder.

Valuations

Lorem Ipsum is simply dummy text of the

printing and typesetting industry.

Fairness Opinions On Exchange Ratio As Per SEBI Regulation

Valuation Of Brands, Intangible Assets & Intellectual Property

Valuation For Tax, Transfer Pricing And Company Law Matters

Valuation Of Infrastructure Assets And Soecialized Assets

Valuation Of Financial For Securities, Instruments And Derivatives

Impairment Studies For Intangible Assets & Goodwill

Valuation Under Insolvency And Bankruptcy Code

Migration to Main Board

SME Company’s listed on Emerge/SME platform of NSE/BSE

are eligible to migrate it’s

securities/listing to Main

Board of NSE/BSE,

post completion of a period of 2 years from its listing.Company that have paid up capital of more 10 Crores and market

cap of 25 Crores are eligible to migrate its securities from SME platform to Main Board of NSE/BSE.

Company is required to take prior permission of stakeholders and have to submit the Information Memorandum with the Stock Exchange.

Post receipt of Stock Exchange In-Principle approval, such SME Companies is migrated from Emerge/SME platform to Main Board of NSE/BSE. Post migration company is required to comply with all corporate governance norms prescribed under SEBI (LODR), Regulations, 2015

-

Corporate

Advisory ServicesProviding Expert Advisory Services

to Top Notch Companies

We provide corporate advisory services to listed

and unlisted

Company’s as follow:

- Capital Re-structuring

- Corporate Re-structuring

- Corporate Advisory Services

- Pre-IPO Placement

- Qualified Institutional Placement

- Fund Raising through private placement

- Post Listing Compliances of Stock Exchange of listed companies

- Restatement of Financial Statement

- Preferential Allotment of Shares

- Debt funding through NBFC’s

- Transaction Advisory

- Issuance of ESOP’s

- Conversion of Financials from GAAP to IND-AS

- Fund Raising through issuing Debt Instruments

Mergers & Acquisition

We assist the companies in mergers and acquisition.

Mergers and Acquisition

helps the companies to

have

an in-organic growth.

We assist listed and unlisted company in its valuation, share exchange ratio, getting requisite approval of Stock Exchange, SEBI and other regulatory authority for the proposed scheme of Merger/amalgamation.

We assist in due-diligence process, preparation of Abridge prospectus, Information Memorandum, finalizing the scheme of

merger/amalgamation, pre and post merger formalities with the Stock Exchange for listing of securities of resulting company.

meet our team

A team is a group of individuals (human or non-human) working together to achieve their goal.

MEET our TEAM

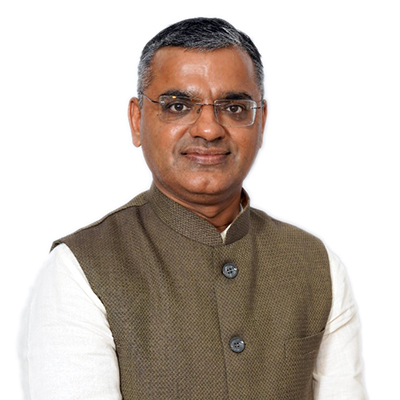

CA YOGESH JAIN

Associate Director

- Over 15 years of professional work experience.

- Worked with National Stock Exchange of India Limited (NSE) and having experience in field of Capital market, Trading, Listings and IPO.

- Instrumental in launch of Currency derivatives segment, mutual fund segment, Interest rate futures and setting up NSE International Stock Exchange - NSE IFSC at GIFT city in Gujarat.

CS Nevil Savjani

Head Merchant Banking

- More than a Decade of experience in Investment Banking.

- Handled 50+ Public offerings (Main Board and SME), More than 15 Takeovers/ Open Offers, QIP’s, Buy Back etc.

- Expertise in SEBI Laws and Corporate/ Company Law Affairs

- Proficient in managing a broad spectrum of Secretarial Compliances of listed companies and also resolving critical secretarial and legal issues.

CS GAGAN KOHLI

Head of Business Development

CS GAGAN KOHLI

Head of Business Development

- Over 5 year of professional work experience

- Worked with Bombay Stock Exchange (BSE) and having experience in field of Capital Market, Trading, Listing and IPO

- Expertise in evaluating Company Business and preparing them for IPO.

CS Ravi Patel

Assistant Manager Merchant Banking

CS Ravi Patel

Assistant Manager Merchant Banking

- He has expertise in Corporate/ Company Law Affairs

- He assisted in handling IPO’s. Open Offers and Valuation of Company.

CA Yashika Gianchandani

Regional Head

CA Yashika Gianchandani

Regional Head

- CA Yashika Gianchandani is a Fellow member of the Institute of Chartered Accountant of India.

- She holds Bachelor Degree of Commerce, Qualified Company Secretary from Institute of Company Secretaries of India (ICSI), ICAI – DISA and Dip-IFRS from ACCA-UK.

- She is having experience of 10 year in capital market and Investment banking with vast knowledge of business restructuring and investment advisory.

- She has handled more than 50 IPO on SME segment

Aanal Parikh

Assistant Manager Business Development

Aanal Parikh

Assistant Manager Business Development

- Over 3 year of professional work experience

- Expertise in business management & back end work.

CS Yash Doshi

Assistant Manger Merchant Banking

CS Yash Doshi

Assistant Manger Merchant Banking

- More than 3 years of experience in Merchant Banking

- Handled 12+ Public Offerings, 5+ Open Offers, 20+ Valuations and various Corporate Actions

- Proficient in Corporate Restructuring, Due Diligence, Drafting and Corporate Advisory Services

CS Yash Doshi

Assistant Manger Merchant Banking

CS Yash Doshi

Assistant Manger Merchant Banking

- More than 3 years of experience in Merchant Banking

- Handled 12+ Public Offerings, 5+ Open Offers, 20+ Valuations and various Corporate Actions

- Proficient in Corporate Restructuring, Due Diligence, Drafting and Corporate Advisory Services

CS Ravi Patel

Assistanr Manager Merchant Banking

CS Ravi Patel

Assistanr Manager Merchant Banking

- He has expertise in Corporate/ Company Law Affairs

- He assisted in handling IPO’s. Open Offers and Valuation of Company.